Form 8621 Calculator – Excel Import Guide

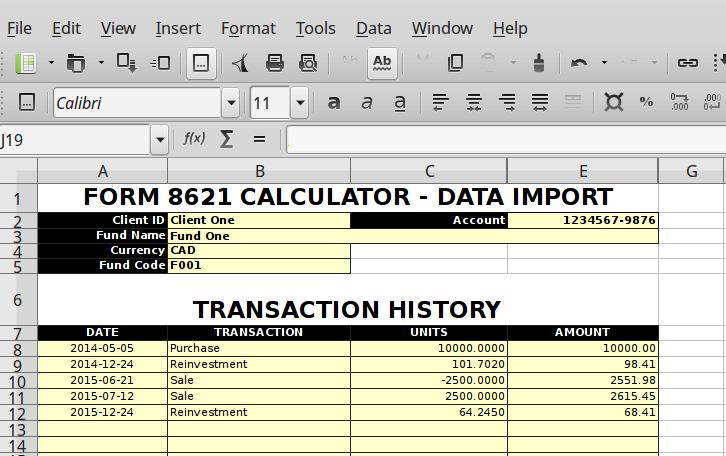

To import the transaction history of the investment from excel, first you must download the “history-import.xls” file which is located in the main menu under the Manuals section.

Open the template and fill in or copy the transaction history into the file. The first six lines are for reference only. It is not used during the import process.

When importing Sales transactions, the number of units can be either Positive or Negative (see lines 10 and 11), for all other transactions, the number of units must be positive.

Save the file and go to the transaction history of the fund.

Select the import ![]() icon and browse for your completed excel document.

icon and browse for your completed excel document.

Click on the “Submit” button to complete the import.

Note that under Section 1291 and 1296, the reinvested distributions and other income received inside of a PFIC do not have a cost base unless reported on a US tax return in the year received by a US person. You may need to edit the transactions and deselect the reported check-box when the client did not report the reinvested or other income on a US tax return.